Cavs: The Free Agent Stock Watch (Eastern Conference Semifinals Edition)

2016-05-12

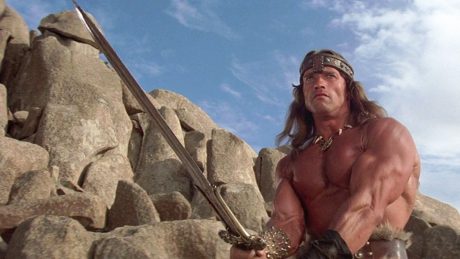

Mongol General: Conan! What is best in life?

Conan: Crush your enemies. See them driven before you. Hear the lamentations of their women.

— Conan the Barbarian (1982)

It’s a little disconcerting, but for once the Cavs and their fans are pointing the business end of what is best in life at the other guys, as we revel in the Cavs’ utter annihilation of their NBA enemies to date.

Unfortunately, it looks like at least one or two of the remaining Conference Semifinals —especially the Eastern Conference Semifinals (or as I prefer to think of it, “we went to a NBA playoff series and a snuff film broke out, and what died was our collective enjoyment of basketball”) — are each going to go six or seven games, and we socially enlightened types at C:TB can only sit around listening to the lamentation of the victims in Detroit and Atlanta for so long before we start feeling awkward and self-conscious. Besides, it’s the Internet age and people don’t have the attention spans they used to back in the Cimmerian days of yore (which based on a history I have pieced together mainly from ogling the sides of airbrushed 70’s vans as a pimply youth, I understand have taken place during Age of Iron Undergarments circa 250 A.D.).

So, welcome to a new feature, the Cavs free agent playoff stock watch! I am your host, the Motley Cav. At the end of each playoff series, I will take a look at the postseason performance of each Cavs rotation player who will, or can, become a free agent at the end of the season. I promise to apply the kind of cold, steely quantitative objectivity and insight that makes Wall Street such a can’t fail enterprise. Okay, not a great or even not terrible example. All stats come courtesy, of course, of Basketball-Reference.com.

In no particular order of priority or importance, let’s start with . . .

LeBron James (Stock Symbol: LBJ)

Contract Status: UFA (player option)

P/E Ratio (season/playoffs): 27.5 / 25.1 PER

Volume (season/playoffs): 35.6 mpg, 27.2 ppg, 7.2 rpg, 6.9 apg, .588 TS% / 38.3 mpg, 23.5 ppg, 8.8 rpg, 7.3 apg, .555 TS%

Performance Against Market (PAM) (season/playoffs): +9.1 / +8.3 BPM

Yield (season/playoffs): 13.6 / 13.3 (extrapolated) Win Shares

Historical Quote: “Warren Buffett told me once and he said always follow your gut. When you have that gut feeling, you have to go with, don’t go back on it.”

Credit Rating: AAA+ stable

Price Forecast: 2 years, $65 million with player option for 2nd year

Trending: Steady

Recommendation: Strong buy — let’s not overthink this one.

The only question with LeBron is that given his age, mileage and how good the Cavs have become, whether he might start to consider cashing in on a long-term deal soon, rather than relying on these year-to-year specials that give him maximum flexibility, leverage (and of course, raises). I don’t see it happening this summer, but I would not be surprised, should the Cavs win a title either this season for the next, if he went in for a long-term max deal after 2017. I mean, we all like having options, but do any of us really need better options than “guaranteed $240 million”? I am thinking at some point soon, even the King will decide the answer is “no.”

J.R. Smith (Stock Symbol: WTF)

Contract Status: UFA (player option)

P/E Ratio (season/playoffs): 12.4 / 14.8 PER

Volume (season/playoffs): 30.7 mpg, 12.4 ppg, 2.8 rpg, 1.7 apg, 2.0 3pg, .542 TS% / 35.0 mpg, 12.3 ppg, 3.8 rpg, 1.6 app, 3.9 3pg, .692 TS%

PAM (season/playoffs): +1.3 / +5.6 BPM

Yield (season/playoffs): 5.5 / 9.2 (extrapolated) Win Shares

Historical Quote: “Best part of the lockout the gold diggers don’t get that money.”

Credit Rating: A+ positive short term, BBB negative long term

Price Forecast:4 years at $60 million, team option on 4th year

Trending: Up in a vertical line

Recommendation: A cautious buy, but only given his stock couldn’t possibly rise any further (right??).

Yes, I know I am talking about J.R. Smith, a player with, shall we say, a checkered past. This was the guy the Bulls traded for and then traded away over an offseason in 2006 without even bothering to give him a proper workout with the team, and also the guy that the Cavs got at fire sale prices in the first place because Phil Jackson thought he was a 2016 Ty Lawson-level team cancer.

At the same time, we are conducting a playoff stock watch here, and right now J.R. is going Books-a-Million in 1998. Steph Curry, the only unanimous MVP in history, led the league during the regular season with a .669 TS%. J.R.’s playoff TS% is .692. Two players in the NBA put up 9.2 WS (J.R.’s extrapolated playoff WS) this season, Paul George and Damian Lillard. J.R.’s playoff BPM of +5.6 would have been good for 10th in the league in-season, just behind Draymond Green (+5.9) and just ahead of Paul Millsap (+5.6).

Obviously I am not claiming that the sample size is large enough for this data to mean anything other than he has been playing out of his mind over the past eight games, but that’s what we’re here to talk about at the Motley Cav. In any event, if he keeps any semblance of this up, Earl Joseph Smith III will be due some serious cabbage this offseason. Yes, he will be on the wrong side of 30, but he has a game that would seem to age well. With the cap going up to possibly $100 million+ for 2016-17, if the Cavs don’t sign him to a big, fat deal they may come to regret, some foolhardy team certainly will (“I throw in truckload unfiltered Marlboros and apartment quadrangle in Sarajevo!”).

Vivek Ranadive, busy at his day job to earn the money he will use to overpay a player who will not help his team. Don’t get cocky EG, I agree with Nate — it definitely could be J.R.!

And so, I would guess that the bidding for Smith’s services in the offseason will start at three years and $13 million a year, more if he continues to play anywhere near this well. Even if J.R.’s game falls into the Springfield Mystery Spot from here on out (by no means an inconceivable happenstance) even then it’s hard to see Smith not getting at least Shump money (4 years, $40 million). I mean, Shump got Shump money, and he’s Shump. The Cavs will have to swallow hard (heck, given the way their luxury tax bill is spiraling out of control, Gilbert probably needs a swig of Pepto-Bismol to sign the player per diem checks at this point) but they really should match any semi- unreasonable offer J.R. might get, given their lack of options and the fact that he has been arguably their second best player this postseason, and that is definitely not for a lack of candidates fighting for that distinction.

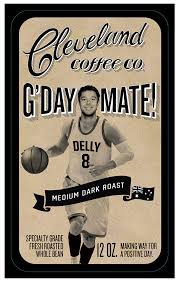

Matthew Dellavedova (Stock Symbol: OZY)

Contract Status: RFA

P/E Ratio (season/playoffs): 11.3 / 15.6 PER

Volume (season/playoffs): 24.6 mpg, 7.5 ppg, 4.4 apg, 1.3 3pg, .527 TS% / 15.9 mpg, 5.9 ppg, 3.6 apg, 0.8 3pg, .543 TS%

PAM (season/playoffs): -1.6 / +2.1 BPM

Yield (season/playoffs): 3.8 / 6.25 (extrapolated) Win Shares

Historical Quote: “I’m pumped to announce my partnership with Cleveland Coffee Company and the creation of our new unique blend of coffee called G’Day Mate!”

Credit Rating: A+ positive

Price Forecast: 5 years, $75 million

Trending: Positive

Recommendation: Hold.

The day is about to get a lot more g’ for Delly, according to the Motley Cav.

I assume many if not most of you are flabbergasted at my price forecast for Delly, but hear me out. Not that you will necessarily like or agree with my rationale, but I think it is a thing that could happen.

With the aforementioned massive cap increase for next year (and more increases on the way) meaning an extra $800 million to $1 billlllllllion dollars to spend on a finite pool of available players, and 20+ teams around the league with cash but no chance of landing an impact superstar free agent, some perfectly nice role players are in for epic overpays in the coming offseason. And who is a nicer perfectly nice role player than Delly?

Quietly, Delly has been very effective so far, playing fewer but more efficient and productive minutes than during the regular season. His playoff TS% of .543 isn’t mind-blowing like Smith’s, but it’s within shouting distance of some pretty decent young point guards (Kemba Walker .554, Eric Bledsoe .557) and better than Reggie Jackson (.535) and John Wall (.510). Oh, and regular season Kyrie (.540, but let’s give him a pass since he struggled coming back from injury). Delly’s extrapolated playoff WS of 6.25 and BPM of 2.1 are also solidly better than his regular season numbers, and if he could build them out in a starter’s role with extended minutes he would be very competitive in those metrics with Tier B point guards around his age, e.g. the Bledsoes, Walkers and Jacksons of the world. Given the potential for some remaining upside and the fact that even in a glue guy role Delly is almost certainly going earn up some significant part of any contract he gets, it’s hard for me not to see some GM taking a flyer and throwing big dollars at him. Remember, Jeremy Lamb (not Lin, Lamb) is getting $7 million a year for 3 seasons from the Hornets starting next season, and he is potentially worthless. Do the math, if a guy whose floor is “worthless” is getting paid $7 million, why would you not pay Delly, whose floor is $7 million a year quality backup, the $7 + $7 and get to $14 million with him? The value equation is basically the same. Not to pick on poor Shump again, but Shump is getting $10 million a year. Terrence Ross signed a 3 year, $31.5 million extension that kicks in 2016-17 onwards. If you ran a basketball team, would YOU feel bad about giving Delly a slightly bigger annual dollar contract than Terrence Ross when you have $30 million more cap space per year to play with anyway? I am thinking not.

Delly is an RFA so a team like the Pistons, Rockets, Grizzlies, Kings, Bucks et al. that wanted to pry Delly away from the Cavs would have deliberately make an overpay, and to do so frankly would be a no-lose situation for teams in the East. If Cleveland matches, they manage to maintain roster status quo, but are looking at a truly astronomical luxury tax bill in 2016-17. If the Cavs do not have the stomach to match, a $5-6 million/year overpay on a player for a small market team will be a drop in the bucket going forward, as discussed above. I mean, if you think that Stan Van Gundy is not sitting around at home right now, his mind furiously racing about how much money he can throw at Delly on July 1 and whether or not there is a way for him to murder Reggie Jackson and get away with it, you are crazy. Or my fictitious version of Stan Van Gundy is crazy. Or I am crazy for saying any version of Stan is secretly plotting to murder Reggie Jackson. Anyway, I am sure of two things – one, Delly will not be driving a Mazda in the Fall (unless he just really, really wants to, I would have to allow) and two, I am very curious to see how this all shakes out for the Cavs. I would of course hope the Cavs match any offer for Delly, but there is going to be a point where the cap hit becomes just too painful for even an owner as held hostage by LeBron generous as Dan Gilbert to match with absolute impunity.

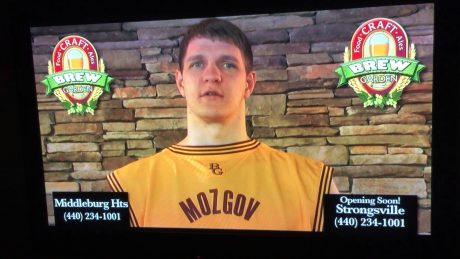

Timofey Mozgov (Stock Symbol: MIA)

Contract Status: UFA

P/E Ratio (season/playoffs): 14.6 / -8.2 PER

Volume (season/playoffs): 17.4 mpg, 6.3 ppg, 4.4 rpg, 0.8 bpg, .593 TS% / 6.8 mpg, 0.0 ppg, 0.3 rpg, 0.3 bpg, .000 TS%

PAM (season/playoffs): -1.2 / -8.5 BPM

Yield (season/playoffs): 3.7/ -1.03 (extrapolated) Win Shares

Historical Quote: “I am hungry for the Brew Garden.”

Credit Rating: BBB- negative

Price Forecast: I dunno, what is the current dollar-ruble exchange rate?

Trending: Flatlining

Recommendation: Donate your shares to charity and get a tax write-off.

We’ll always have the Brew Garden.

What a difference a year makes. Had Timo hit free agency last season, I think a very nice contract in the multiyear, $10+ million a season deal would have definitely been in the cards after his redemption year and yeoman’s playoff showing. However, this season was a lost one for the big Russian and the playoffs have been a complete disaster for him personally, if not for the team. Frye and TT are simply much better fits for what the Cavs are doing these days, and Mozzy even when he sees the floor seems tentative and demoralized. He’s still relatively young (29) and probably at this point is best off taking a 2-year deal in Europe, licking his wounds and planning a 2018 comeback.

Mo Williams (Stock Symbol: TPE)

Contract Status: UFA, player option

P/E Ratio (season/playoffs): 12.4 / 11.0 PER

Volume (season/playoffs): 18.2 mpg, 8.2 ppg, 2.4 apg, 0.9 3pg, .527 TS% / 4.3 mpg, 1.7 ppg, 0.0 apg, 0.3 3pg, .500 TS%

PAM (season/playoffs): -3.3 / -1.6 BPM

Yield (season/playoffs): 1.1 / 0 (extrapolated) Win Shares

Historical Quote: “I couldn’t think of no better job that I could do right now and still have the fulfillment and making the amount of money that I’m making, to be honest with you.”

Credit Rating: BB- stable

Price Forecast: Picks up player option for 1 year, $2.2 million

Trending: Down

Recommendation: Sell, divest, transfer, assign, convey.

Not much to say about Mo. Unlike Mozzy he hasn’t been particularly terrible during the playoffs, but with a shortened bench and generally good roster health he hasn’t been needed. During the regular season he started strong but struggled with injuries and inconsistency thereafter, and nothing he has shown since then or during these playoffs gives me any reason to think that he can be a useful piece for a championship contending team like the Cavs going forward. I have to assume that Mo will pick up the extra year of his deal since it gives him a few extra dollars over the league veteran’s minimum that he otherwise would draw, and given the Cavs’ truly dire cap situation I wouldn’t be surprised if they ship him off to some bad team with cap space for a traded player exception, just for the luxury tax savings. I think Mo still has something to offer to a team like the Sixers or the Magic as a veteran off the bench on a cheap contract, but the playoffs have only reinforced my notion that he is nothing more than an insurance policy for this particular team, and pretty crappy insurance at that.

James Jones (Stock Symbol: JFJ)

Contract Status: UFA

P/E Ratio (season/playoffs): 11.6 / -24.0 PER

Volume (season/playoffs): 9.6 mpg, 3.7 ppg, 1 rpg, 0.9 3pg, .580 TS% / 4.5 mpg, 0.0 ppg, 0.5 rpg, 0.0 3pg, .000 TS%

PAM (season/playoffs): -1.0 / -28.6 BPM

Yield (season/playoffs): 1.2 / -1.03 (extrapolated) Win Shares

Historical Quote: “I told J.J. as long as I’m playing, he’s going to be around . . . I’m going to make sure I got a roster spot for him.” – LeBron James on James Jones

Credit Rating: Junk but backed by AAA+ guarantor

Price Forecast: 1 year, veteran’s minimum ($1.6 million projected)

Trending: Are you kidding? Read the quote from LeBron. JFJ don’t have to trend.

Recommendation: I would say sell, if it were not for the lock-up order from the CEO.

James Jones just keeps on JFJ’ing, albeit he is getting a little worse at it all the time, hitting the occasional 3, playing a little D, and being the Cavs’ human victory cigar. His playoff stats this postseason are negligible . . . but it really doesn’t matter for LeBron James’ personal security blanket, does it?

Given Jones makes the veteran’s minimum I can’t see the Cavs finding any pressing need to replace him at the back of the rotation, on LeBron’s behest. Unless Jones retires, which strikes me as a possibility if the Cavs win the title this season, I believe he will be back for one more season.

Richard Jefferson (Stock Symbol: RFJ)

Contract Status: UFA

P/E Ratio (season/playoffs): 9.7 / 12.4 PER

Volume (season/playoffs): 17.9 mpg, 5.5 ppg, 1.7 rpg, 0.9 3pg, .585 TS% / 14.3 mpg, 4.5 ppg, 1.6 rpg, 1.0 3pg, .720 TS%

PAM (season/playoffs): -0.8 / 1.7 BPM

Yield (season/playoffs): 2.7 / 3.75 (extrapolated) Win Shares

Historical Quote: “North Carolina, Duke, Arizona and Kentucky are all Nike schools, so if you are going to a top program, most of them are Nike.”

Credit Rating: BBB positive

Price Forecast: 2 years, $6 million

Trending: Up

Recommendation: Hold.

Yes, but don’t get too excited. It isn’t by much.

Jefferson signed with the Cavs for the league minimum hoping to win another ring. He has been a pleasant surprise in the playoffs, providing quality rotation minutes and displaying a very high level of competency in the 3-and-D role that JFJ only fills as a memory these days. Jefferson has been an offensive terror in a limited role, with a torrid .720 TS% including 60% from three. Given how well he has filled the poor man’s Bruce Bowen role this postseason while staying in excellent shape, I can see some mid-tier playoff team looking for veteran wing (the Pistons, Hornets and Raptors come to mind) being willing to give him a bit more in terms of years and money. I think the Cavs would be wise to match whatever he gets within reason, but but given the Cavs gruesome luxury tax situation I don’t think it would take much to outbid them on Jefferson. While I would be sad to see him go, I am reasonably confident Griff will find a suitable replacement for less money if that is the case. In Griff I trust.

I was just looking at the schedule and it looks like no matter what the Cavs will play tues then thursday but the thing that confuses me about the way the NBA schedules is that while the WC teams will then have three days off and play on sunday it looks like the East will play on saturday with one day off…Is there any good reason not to put the WCF game on saturday and the ECF on Sunday giving both matchups two days off…I just don’t understand how they schedule these games…It makes no sense…

Because the Warriors

That’s absolutely the answer…

I don’t think I have ever seen a competitive seven game series that was such a displeasure to watch not involving the Grizzlies.

Two additional days of rest for the Cavs. Just hope they finish the ECF in 4 or 5 games while the Thunder and Warriors go to double overtime in 7 straight games.

Game 6 of the Guppy Bowl, as Charles Barkley called it. Not an exciting game, Raptors hanging around.